how to change how much taxes are taken out of paycheck

To figure out the yearly amount take the new amount withheld per pay period and multiply it by the number of remaining pay periods. How do I calculate the percentage of taxes taken out of my paycheck.

7 Paycheck Laws Your Boss Could Be Breaking Fortune

You need to submit a new W-4 to your employer giving the new amounts to be.

. How do I get the least taxes taken out of my paycheck in 2021. Normally 62 of an employees gross pay is taken out for this purpose and another 62 is paid by the employer. The amount of federal tax withholding can be adjusted to account for different situations that.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. If youd like to calculate the overall percentage of tax deducted from your paycheck first add up the dollar. How To Adjust Your Withholding To adjust your withholding is a pretty simple process.

You are in the 10 bracket so your yearly taxes are 340 or. If you increase your contributions your paychecks will get smaller. So if you elect to save 10 of your income in your companys 401 k plan 10 of your pay will come out of each paycheck.

To adjust your withholding is a pretty simple process. During the deferral period lasting through December 31. Federal Tax Withholding is the amount of taxes that are taken from your paycheck.

FICA taxes are commonly called the payroll tax however they dont include all taxes related to payroll. Increase the number of dependents. Whats the percentage of taxes on my paycheck.

Reduce the number on line 4a or 4c. The 2019 standard deduction for a single tax payer is 12200 so you would owe tax on 15600 - 12200 3400. Complete a new Form W-4P Withholding Certificate for Pension or.

If you are paid hourly multiply your hourly wage by the number of hours you work per pay period. This is a rough estimate of what your. You need to submit a new W-4 to your employer giving the new amounts to be withheld.

Increase the number on line. If you prefer owing the IRS at years end rather than receiving a refund you may need to complete a new W-4 form to change the tax that your employer withholds from your. For example in 2011 the IRS gives 1423 per allowance for a daily payroll 7115 for a weekly payroll 14231 for a biweekly payroll 15417 for a semimonthly payroll and.

For example if you earn 15 per hour and work 80 hours per pay period. FICA taxes consist of Social Security and Medicare taxes. Its kinda blind -- all it does is take your current paycheck and multiply it by the number of paychecks your payroll department cuts per year.

It assumes that is your annual income. If too much tax is being taken from your. The Social Security tax is 62 percent of your total pay until you reach an annual income threshold.

How To Calculate Take Home Pay As A Percentage Of Gross Pay The Motley Fool

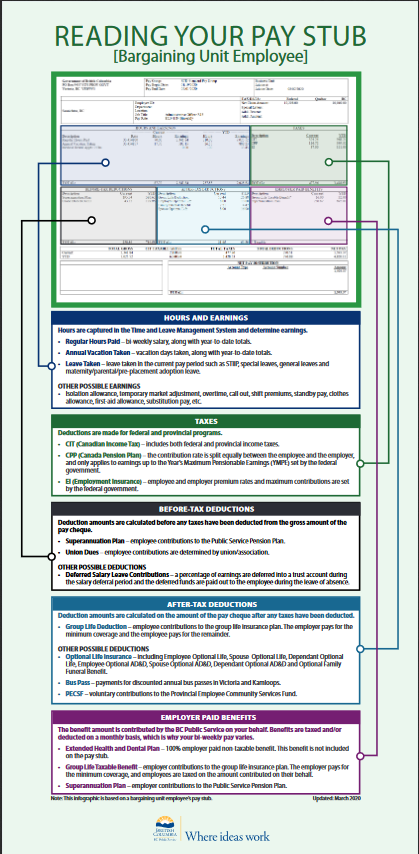

Understanding Your Pay Statement Office Of Human Resources

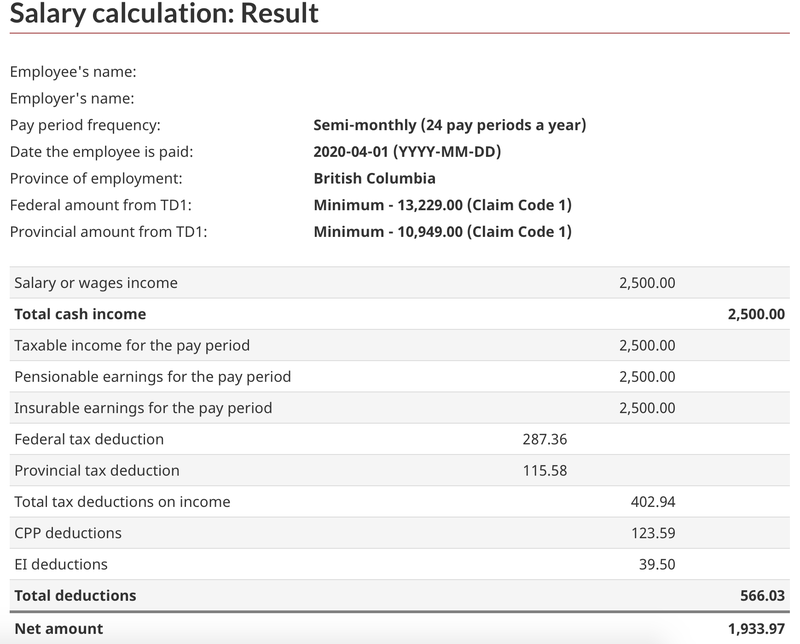

How To Do Payroll In Canada A Step By Step Guide The Blueprint

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Here S How Much Money You Take Home From A 75 000 Salary

Calculating Federal Taxes And Take Home Pay Video Khan Academy

Different Types Of Payroll Deductions Gusto

Paycheck Calculator Online For Per Pay Period Create W 4

Payroll Deductions As Liabilities Vs Payroll Expenses

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

How To Read Your Pay Stub Province Of British Columbia

Pay Stub Meaning What It Is And What To Include On A Pay Stub

Free Online Paycheck Calculator Calculate Take Home Pay 2022

What Are Payroll Deductions Article

How To Calculate Payroll Tax Deductions Monster Ca