iowa property tax calculator

Example 1 - 1000 property taxes with a closing date of February 1. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Dubuque County.

Pin On Global Issues Economics

There are some exceptions for people in the military and nursing homes who may otherwise qualify.

. The final tax rate is the result of budgets established to provide services an assessors assessment a county auditors calculations and laws administered by. If you would like to update your Iowa withholding amount file the 2022 IA W-4 44-019 form with your employer. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price.

Iowa Real Estate Transfer Tax Calculator. Annual property tax amount. The tax is imposed on the total amount paid for the property.

Total Amount Paid. Iowa Real Estate Transfer Tax Calculator Transfer Tax 711991 thru the Present. Full or partial payments of current and delinquent taxes will be accepted at any.

A number of adjustments and separate Iowa calculations are necessary to determine the correct deduction. The median property tax on a 13730000 house is 177117 in Iowa The median property tax on a 13730000 house is 144165 in the United States Remember. Our Iowa Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Iowa and across the entire United States.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Des Moines County. Annual property tax amount. Conducting the annual tax sale for the collection of delinquent taxes.

This Calculation is based on 160 per thousand and the first 500 is exempt. That is slightly lower than the national average but because Iowa home values are also lower than the national average the average effective property tax rate annual taxes as a percentage of home values ranks much higher. On a home with an assessed value of 200000 the total tax bill would be 4000.

This calculation is based on 160 per thousand and the first 500 is exempt. This calculation is based on 160 per thousand and the first 50000 is exempt. The new 10000 federal cap on the itemized deduction for state and local taxes does not apply for Iowa purposes.

Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. Type your numeric value in the appropriate boxes then click anywhere outside that box for the Annual Gross Total to appear. SimplyDesMoines Iowa TaxPro Calculator.

Check the chart below for the surtax rates for Iowa school districts. Certain circumstances may cause the amount of Iowa withholding tax calculated by the withholding calculator to differ from a taxpayers paycheck. Property taxes are not determined by a single individual who assesses your property and sends you a bill.

Based on January 1 2020 assessments for taxes payable September 2021 first half and March 2022 second half. To qualify for the credit the property owner must be a resident of Iowa and actually live in the property on July 1 and for at least six months of every year. Property tax proration.

Iowa Tax Proration Calculator Todays date. You must complete the Iowa Schedule A to itemize deductions on the Iowa return. The median property tax on a 13680000 house is 176472 in Iowa The median property tax on a 13680000 house is 143640 in the United States Remember.

Property tax calculator iowa. Dallas County Iowa Courthouse 801 Court Street Rm 203 PO Box 38 Adel IA 50003 Phone. The table below shows the average effective tax rates for every county in Iowa.

January 1 2020 Assessed Value. By Harold Rockatansky Leave a Comment on Property tax calculator iowa. You are able to use our Iowa State Tax Calculator to calculate your total tax costs in the tax year 202122.

Type your numeric value in the appropriate boxes then click anywhere outside that box or press the tab key for the total amount Due. What is Transfer Tax. Tax rates are denominated in dollars per thousand.

The first half or 500 of the previous years taxes was paid in September and the second 500 will assumingly be paid on March 1. The Amount Payable Online represents all taxes that are payable online for each parcel listed in either the first September or second March payment period. Iowa Tax Proration Calculator Todays date.

The credit is a reduction in the amount of property tax owed. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on similar homes in Marion County. Tax amount varies by county.

Since the closing date is on February 1 the current taxes due are 500 and the prorated taxes for the current fiscal year are calculated from July 1 through January 31. Rounded Up to Nearest 500 Increment. To view the Revenue Tax Calculator click here.

You may calculate real estate transfer tax by entering the total amount paid for the property. So if your total tax rate is 20 that would mean you owe 20 in taxes for every 1000 in assessed value. So if you pay 2000 in Iowa state taxes and your school district surtax is 10 you have to pay another 200.

The County Treasurer is responsible for. Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. Enter the total amount paid.

How are property taxes calculated in Iowa. Administering the Iowa Property Tax Credit Program. It is not a refund.

Iowa is ranked number twenty eight out of the fifty states in order of the average amount of property taxes collected. Do not type commas or Dollar signs Into number fields. The median property tax in Iowa is 156900 per year for a home worth the median value of 12200000.

Collecting taxes for real estate property mobile homes utilities bushels of grain monies and credits buildings on leased land and city and county special assessments. The assessed value of the property and the total local tax rate. 328 rows The average property tax paid in Iowa is around 2430 a year.

Taxes are based on two factors. Property values in Iowa are assessed every two years by county and city assessors. Property taxes may be paid in semi-annual installments due September and March.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. The median property tax on a 9040000 house is 116616 in Iowa The median property tax on a 9040000 house is 94920 in the United States Remember. Counties in Iowa collect an average of 129 of a propertys assesed fair market value as property tax per year.

North Central Illinois Economic Development Corporation Property Taxes

Property Tax Calculation Youtube

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment

28 Maps That Will Teach You A Damn Thing About Your State For Once Maps Pinterest Humor

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Which States Have The Lowest Property Taxes Property Tax Usa Facts History Lessons

Property Tax Comparison By State For Cross State Businesses

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

Top Income Tax Rate By State States With No Income Tax 1 Alaska 2 Florida 3 Nevada 4 South Retirement Income Best Places To Retire Retirement Locations

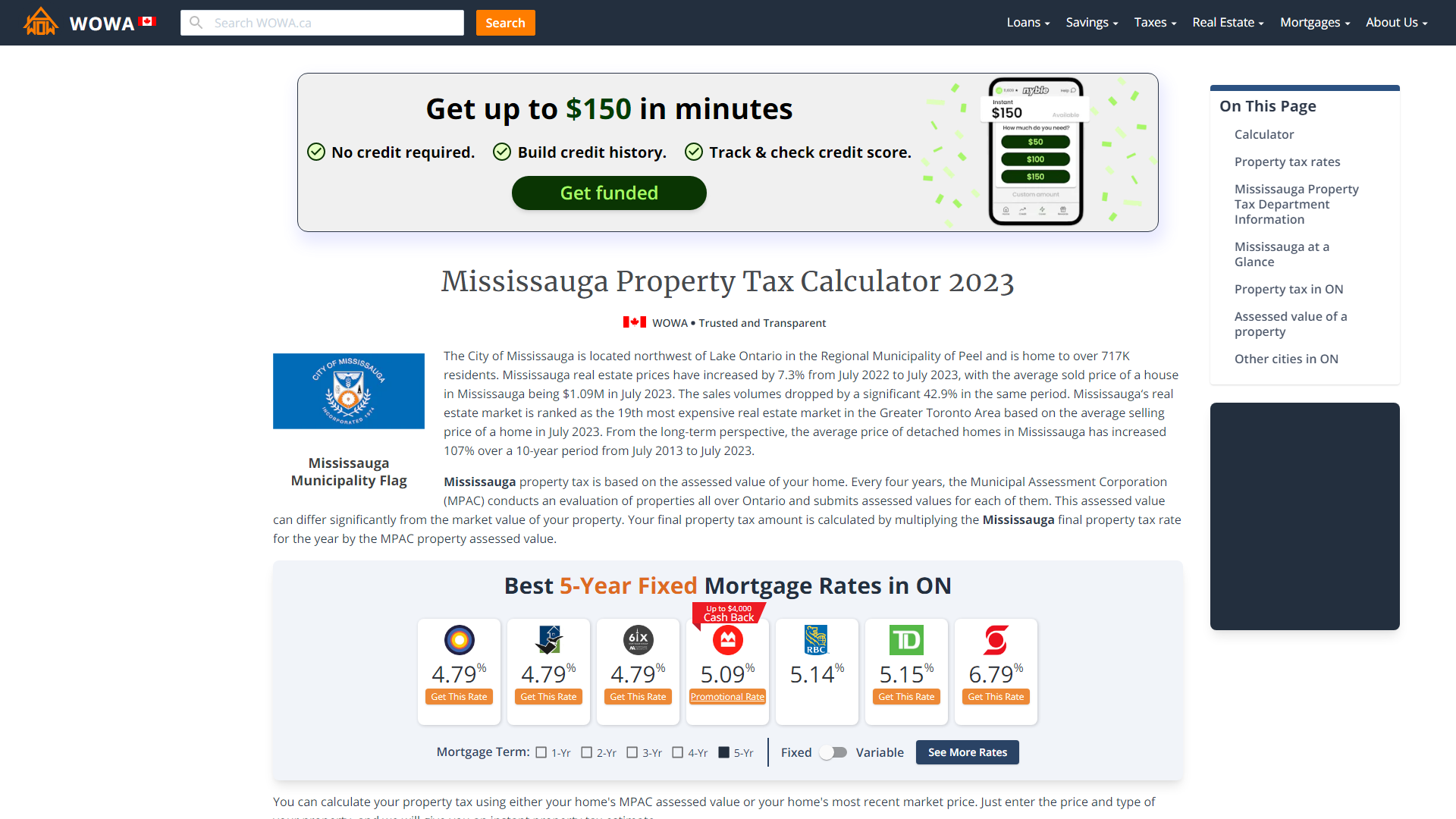

Mississauga Property Tax 2021 Calculator Rates Wowa Ca

Orange City S Total Property Tax Levy Rate Ranks 551st In The State Orange City

How To Calculate Basis Points Sapling Calculator Direct Marketing Things To Sell

Notice From The City Of Oskaloosa City Social Media Pages Previous Year

Keep Precise Records Of Rental Income And Rental Expenses For Your Rental Income Business With This Print Business Tax Being A Landlord Business Tax Deductions

Florida State Sales Tax Over View With The Sales Tax Holiday Listed Florida State Sales Tax Tax

How To Calculate Property Tax Everything You Need To Know New Venture Escrow

South Carolina Property Tax Calculator Smartasset In 2021 Retirement Calculator Retirement Strategies Savings And Investment