how is capital gains tax calculated in florida

Investments are taxed at capital gains rates. Additional inputs available for calculating adjusted tax basis and depreciation recapture including depreciation debt and.

![]()

What Is My Tax Rate For My Crypto Gains Cointracker

You can also add sales expenses like real estate agent fees to your basis.

. Capital gains tax is payable on the net gain from the sale of property. Long-term capital gains taxes on the other hand apply to capital gains made from investments held for at least a year. Using the short-term capital gains tax rates shown above the tax bill on your home sale would be 109736.

Capital losses can be used to offset capital gains and can be carried forward to future tax years. This rate is your ordinary income tax rate. Depending on how long you hold your capital asset determines the amount of tax you will pay.

2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. The amount that can be excluded stands at 250000 for an individual and 500000 for a married couple. A good capital gains.

Payable on the net gain of your property to the IRS. Take advantage of primary residence exclusion. You can calculate capital gains taxes using IRS forms.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Capital gains tax is owed when you sell a non-inventory asset at a higher price than you paid resulting in a realized.

The long-term capital gains tax rate is typically 0 15 or 20 depending on your tax bracket. Capital Gains Tax. There are two capital gains rates short and long-term.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. 250000 of capital gains on real estate if youre single.

Calculate the capital gains tax on a sale of real estate property equipment stock mutual fund or bonds. Our capital gains tax calculator determines the total tax that you will have to pay on the profit or capital gain you earned from selling an asset. If youre married you can keep up to 500000 in capital gains tax free.

When you sell your primary residence 250000 of capital gains or 500000 for a couple are exempted from capital gains taxation. Generally if you buy a home and live there as your primary residence for two of the past five years you can keep up to 250000 in capital gains tax free. Ncome up to 40400 single80800 married.

Holding on to your home for at least a year would convert this to a long-term capital gain and reduce your capital gains tax bill to 52500 or 15 of your profit. FIRPTA Withholding 15 of gross sale price of property Long Term and Short Term Gain. Includes short and long-term Federal and State Capital Gains Tax Rates for 2021 or 2022.

Long-term gains are taxed at a lower rate. 10 12 22 24 32 35 and 37. Your primary residence can help you to reduce the capital gains tax that you will be subject to.

Capital gains are the profits you make when you sell a stock real estate or other taxable asset that increased in value while you owned it. Income over 40400 single80800 married. The capital gains tax is based on that profit.

You do not have to pay capital gains tax until youve sold your investment. Investments that are held for less than a year are taxed at the short-term gains rate. The gain is calculated by taking the sale price less the purchase price and all related.

How to Avoid Capital Gains Tax on a Home Sale. Capital gains tax cgt breakdown. Short-term capital gains are treated as income and are taxed at your marginal income tax rate but long-term capital gains are taxed at a rate of 0 15 or 20 depending on your total income.

Florida has no state income tax which means there is also no capital gains tax at the state level. Heres how the capital gains tax currently works. There may be a bracketed system where the rate is higher as the dollar value of the capital gains go up or there may be a flat tax rate for all long-term.

Record each sale and calculate your hold. It uses the date of the sale adjusted basis sales price cost commissions exchange fee liabilities and mortgages. Income over 445850501600 married.

Short-term capital assets are taxed at your ordinary income tax rate up to 37 for 2022. 500000 of capital gains on real. But if you sell the home for less than the stepped-up.

The IRS typically allows you to exclude up to. Defer Capital Gains Tax by using 1031 Exchange. Investors who hold for a year or more get the long-term gains rate.

The capital gains tax in Florida applies to earnings from investments including real estate. Calculating capital gains on sale of home. Obtaining the amount requires you to make adjustments including acquisition and improvements costs.

Below is more information about the capital gains tax and how to use this calculator. Calculating Capital Gains On Your Florida Home Sale In real estate capital gains are based not on what you paid for the home but on its adjusted cost basis. The long-term capital gains tax rate is 0 15 or 20 depending on your taxable income and.

You can maximize this advantage by frequently moving homes. Hawaiis capital gains tax rate is 725. Subtract that from the sale price and you get the capital gains.

Individuals and families must pay the following capital gains taxes. 5 Financial Planning Mistakes That Cost You Big-Time and what to do instead Explained in 5 Free Video Lessons. That applies to both long- and short-term capital gains.

Requires only 7 inputs into a simple Excel spreadsheet. At the federal level and in some states these are taxed at a lower percentage than normal income. Long-term capital gains tax is a tax on profits from the sale of an asset held for more than a year.

To calculate and report sales that resulted in capital gains or losses start with IRS Form 8949. There is currently a bill that if passed would increase the.

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Capital Gains On Selling Property In Orlando Fl

How High Are Capital Gains Taxes In Your State Tax Foundation

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

How To Avoid The Capital Gains Tax Loans Canada

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

How To Pay 0 Capital Gains Taxes With A Six Figure Income

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax Calculator 2022 Casaplorer

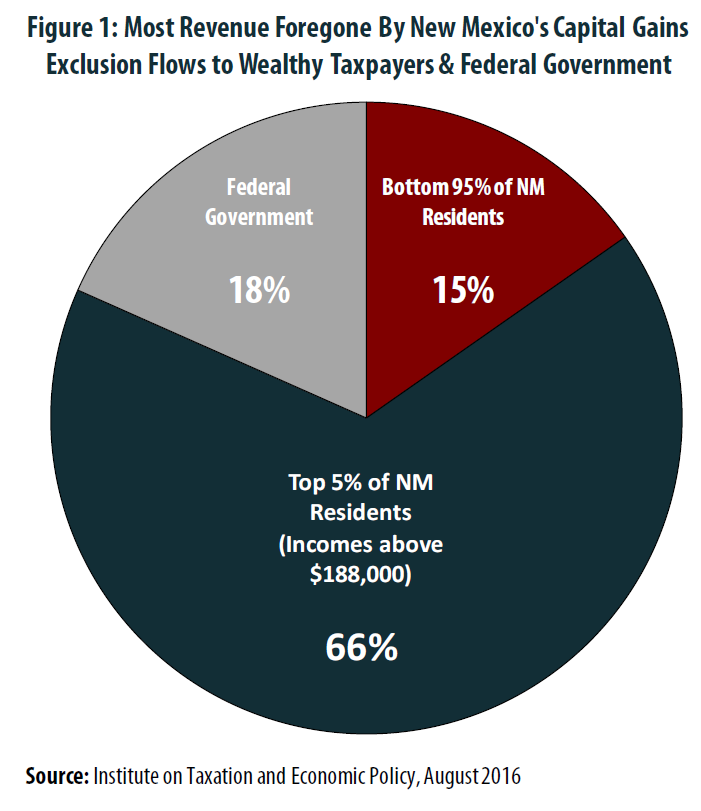

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The Folly Of State Capital Gains Tax Cuts Itep

The States With The Highest Capital Gains Tax Rates The Motley Fool

What Is Capital Gains Tax And When Are You Exempt Thestreet

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep